Whether you’re transferring funds to loved ones across the globe or handling urgent payments, Western Union provides a wide range of options designed to suit different needs and preferences.

With over 500,000 agent locations worldwide, flexible payment methods, and multiple delivery options, it’s no surprise that many rely on Western Union for their money transfers.

In this article, we’ll explore the key features of Western Union’s services to help you make an informed choice on whether Western Union is the right money transfer solution for you.

- Western Union Key Features

- Global Coverage

- Multiple Ways to Send Money

- Fast and Convenient Transfers

- Flexible Receiving Options

- Loyalty Programme: My WU

- Western Union Pricing and Fees

- Western Union Pros and Cons

- Western Union Customer Reviews

- Western Union Security Measures

- Western Union Recent Updates and Recognitions

- Conclusion

- Disclaimer

Western Union Key Features

Global Coverage

Western Union operates in over 200 countries and territories, with a vast network of agent locations and banking partners. Whether you’re sending money across the street or the world, Western Union makes it easy to reach your loved ones.

Multiple Ways to Send Money

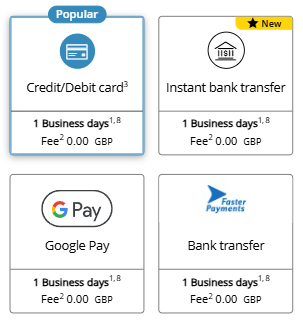

Western Union gives you the flexibility to send money in a way that suits you. You can transfer money online via WesternUnion.com, through the Western Union mobile app, or in person at an agent location. Payment options include:

- Debit or credit card – for fast online transfers

- Bank transfer – pay directly from your online banking using Klarna, Trustly, or iDEAL

- Google Pay – a quick and secure option available on Android devices and the website

- Cash at an agent location – set up the transfer online and complete payment in person

Fast and Convenient Transfers

Need to send money in a hurry? Western Union offers money in minutes for cash pickups when paying by debit or credit card. If you’re sending to a bank account, the transfer usually arrives within one to two business days, depending on the country and receiving bank. Mobile wallet transfers can also be completed within minutes if the receiver has an activated wallet with a partner provider.

Flexible Receiving Options

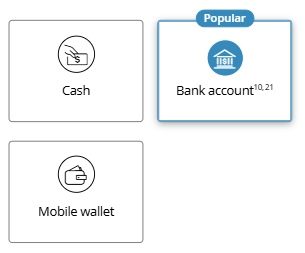

Receivers have multiple options to collect their money:

- Cash pickup – available at hundreds of thousands of Western Union locations worldwide

- Bank deposit – money is sent directly to the recipient’s bank account, typically within 1–3 business days

- Mobile wallet – money can be sent directly to a mobile wallet for easy access if available in the recipient’s country.

Loyalty Programme: My WU

Frequent senders can earn rewards with Western Union’s My WU loyalty programme. Members can collect points on every transfer and redeem them for discounts on future transactions.

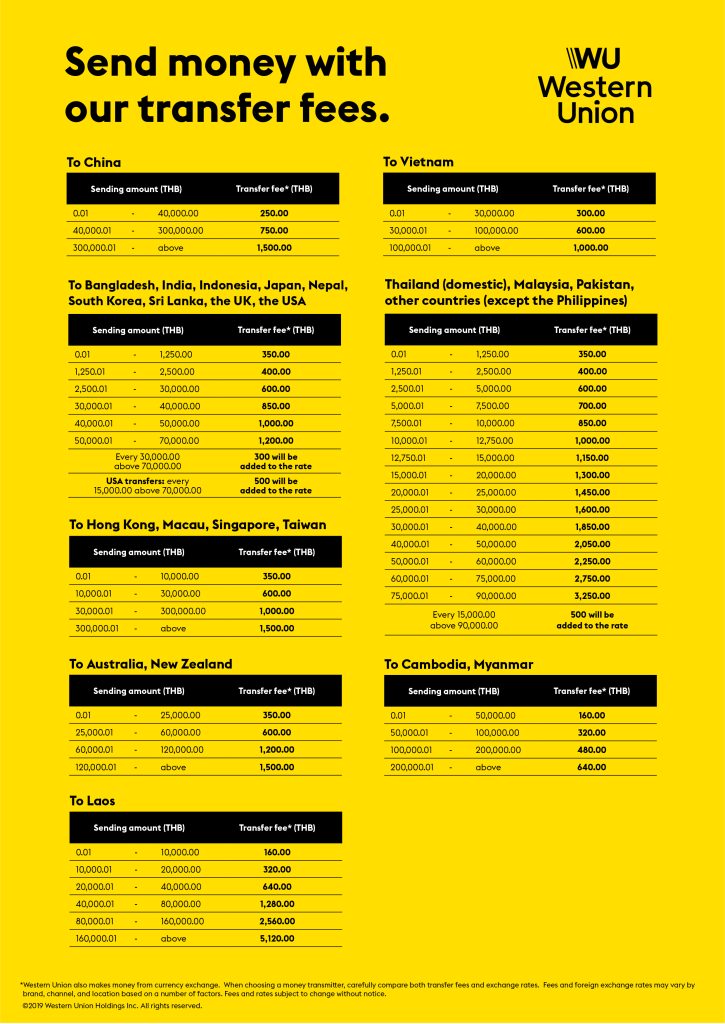

Western Union Pricing and Fees

Western Union provides upfront pricing before you send money, so you always know the exact fees and exchange rates.

Western Union doesn’t always use the exact market rate you might see online or on currency conversion apps. They apply their rate, which includes a small margin on top of the market rate.

Exchange rates and transfer fees vary depending on the payment method, destination, and transfer speed, so that you might see slightly different rates depending on your choices.

Some card issuers and services like Klarna may charge additional fees when using this payment method. Similarly, sending money to a mobile phone might come with its fees, depending on the country and the mobile operator you’re sending to.

Sometimes, the receiver might have to pay additional charges, depending on their chosen bank or payout method. So, it’s also good to check with them to ensure no surprises!

Western Union Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Fast transfers are available in just minutes | Adds exchange rate markup |

| Cash pickup service | Charges transfer fees |

| Wide network of over 500,000 agent locations | Large transfers require additional verification |

| Multiple payment methods | Some services, like cash pickup, are not available everywhere |

| Mobile wallet transfers are available | You must be a UK resident to send transfers from the UK |

| My WU loyalty programme | |

| Some locations are open 24/7 |

Western Union Customer Reviews

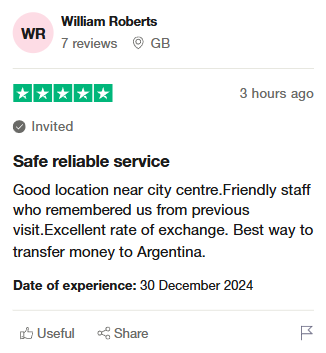

As of January 2025, Western Union has earned consistently positive customer feedback, with an “excellent” 4.3 out of 5 on Trustpilot, based on 112 219 reviews. Similarly, its mobile app has been rated 4.8 out of 5 on the Apple App Store, based on 1 million ratings, and 4.5 out of 5 on the Google Play Store, based on 130,000 reviews.

Many customers praise Western Union’s speed, reliability, and ease of use. Users appreciate the quick transaction times and efficient customer support, particularly for resolving issues and ensuring timely fund delivery. Long-term users express confidence in the service, highlighting its seamless process.

However, several complaints are made about slow website performance, app crashes and high fees. Delays and cancellations are common complaints, particularly for transfers to specific regions like Africa and Eastern Europe. Customers also report difficulties with verification processes, unresponsive support, and issues redeeming promotional points.

Western Union Security Measures

Western Union is regulated by the Financial Conduct Authority and takes several steps to keep your money safe. Here’s a simple breakdown of the security measures they use:

- Advanced Encryption: When you send money online, your information is locked down and can’t be accessed by anyone else.

- Secure Payment Options: When you pay for your transfer with a debit or credit card, Western Union follows the latest security standards. They also work with your bank to verify that you are really making the payment, so it’s harder for fraudsters to use stolen card details.

- Identity Verification: Western Union may ask you to verify your identity for larger transfers (or sometimes if you’re sending money frequently). This can include providing a government ID or doing a video chat. This extra step helps ensure that only the right person can send or receive the money.

- Monitoring for Fraud: Western Union monitors transactions for suspicious activity. Its systems look for signs of fraud, such as unusual sending patterns or large transfers. If anything seems off, they might contact you for more details.

- Safe Pick-Up Process: When the receiver picks up the money, they must provide a tracking number (MTCN) and a valid ID. This ensures that the money goes to the right person.

- Fraud Prevention Alerts: Western Union warns customers to be cautious when sending money, especially to people they don’t know. They have clear guidelines to help you avoid common scams, like fake job offers or urgent requests for money from “friends”.

Western Union Recent Updates and Recognitions

Western Union was founded in 1851 in Denver, Colorado, as the New York and Mississippi Valley Printing Telegraph Company. Over time, it evolved from a telegraph service to the world’s largest provider of cross-border money transfers.

Western Union deepened its long-term partnership with Mastercard in 2021, integrating Mastercard Send into its platform. This integration allows customers to send money directly to debit cards in 16 European markets, with more countries to follow. This service speeds up transfers and provides greater convenience for recipients, making the process more seamless and immediate.

In 2022, Western Union expanded its collaboration with the UK Post Office to enhance its omni-channel offering. This means UK customers can now send money internationally through 4,000 Post Office locations across the UK. This collaboration strengthens Western Union’s reach and accessibility, especially in communities with limited local banking services.

Conclusion

In conclusion, Western Union offers a comprehensive and accessible money transfer service with various features to meet different needs. Its global coverage, multiple transfer methods, and fast, reliable service make it a strong choice for sending money worldwide.

The convenience of cash pick-ups, bank deposits, and mobile wallet transfers, combined with its loyalty programme, My WU, adds significant value for frequent users.

While the service excels in speed and customer support, it is not without its drawbacks, including high fees, exchange rate markups, and occasional technical issues with the app and website.

Despite some customer concerns, Western Union remains a reliable, widely used service that continuously strives to enhance its offerings and user experience.

Disclaimer

The information in this article is for general purposes only and is not financial advice. While we try to keep everything accurate and up-to-date, it may not apply to your specific situation or reflect the latest changes in money transfer services.

Before making any financial decisions, such as choosing a money transfer service, speaking with a financial adviser who can advise you based on your needs is a good idea. Western Union and other services mentioned may not be right for everyone, so consider fees, exchange rates, and regulations before moving forward.

You are responsible for how you use this information, and we are not liable for any decisions you make based on it. Always check the terms and conditions with the service provider before completing any transactions.

FAQs

Western Union money transfer allows you to send money to someone across the world through various methods. You can send money online, via their mobile app, or in person at an agent’s location. Payment can be made using a debit/credit card, bank transfer, or cash. The recipient can collect the money in several ways, including cash pickup at an agent location, bank deposit, or mobile wallet transfer.

Western Union’s fees for sending money depend on several factors, including the payment method, the destination, and how quickly the money needs to be transferred. For example, paying by debit or credit card usually incurs a higher fee, while bank transfers may be cheaper. Fees can also vary based on the transfer amount and the type of delivery method chosen (such as cash pickup or bank deposit). Western Union provides upfront pricing before you send money, so you can see the exact cost before completing the transaction. Additionally, they may apply a markup on exchange rates.

Yes, Western Union is generally considered safe for money transfers. The company uses advanced encryption to protect personal information and follows secure payment standards. It also has identity verification processes for larger transfers, monitors transactions for suspicious activity, and requires recipients to provide identification to pick up funds.

The Western Union transfer limits vary depending on your identity verification status and transfer method. You can send up to £800 per transfer online if your identity hasn’t been verified. Once verified, you can send up to £4,000 every three days using a credit card or up to £50,000 via a bank transfer. There are usually no set limits for in-person transfers, but for larger amounts, you may need to provide additional information or documentation for security checks.

The time for a Western Union bank transfer depends on the destination and the receiving bank. Typically, transfers to bank accounts take between one to two business days. However, the exact duration can vary depending on the country and the specific bank receiving the funds. If you need to send money quickly, Western Union offers faster options, such as cash pickups or mobile wallet transfers, which can be completed in minutes.

Sending money through Western Union can be a good option if you need fast, reliable transfers, especially for international transactions. With a vast network of agent locations and multiple payment methods, it offers flexibility and convenience. However, the fees can be higher than some alternatives, and the exchange rates may include a markup. Considering these factors and ensuring the service meets your specific needs before using it is essential.