If you’re looking to send money abroad, Barclays offers a reliable service with a range of options for both personal and business customers.

Whether you need to send euros within Europe or manage international payments for your business, Barclays provides flexible solutions.

In this article, we’ll explore the features, fees, and transfer options available, helping you decide if Barclays is the right choice for your global money transfers.

- Barclays Money Transfer Key Features

- Broad Currency and Country Coverage

- Fast SEPA Transfers

- Multiple Fee Payment Options

- Barclays Payment Limits

- Foreign Currency Accounts for Businesses

- Multi-Channel Access

- Barclays International Payments Pricing and Fees

- Barclays Global Payments Pros and Cons

- Barclays Money Transfer Service Customer Reviews

- Barclays Money Transfer Security Measures

- Barclays Recent Updates and Recognitions

- Conclusion

- Disclaimer

Barclays Money Transfer Key Features

Broad Currency and Country Coverage

Personal and business customers can send money to over 200 countries in 50+ currencies.

While most transfers can be made online or via the Barclays app, some destinations—like Algeria, Nepal, and Uruguay—require branch visits.

Business customers can also use Barclays International Payments Services (BIPS) for electronic transfers worldwide, choosing between standard (3-8 working days) or priority (1-3 working days) options.

Fast SEPA Transfers

Barclays offers SEPA (Single Euro Payments Area) payments, ensuring quick and cost-effective euro transfers across Europe. When possible, personal and business customers benefit from same-day transfers, with no fees for personal customers using online banking or the app. Business accounts may have small fees depending on the tariff.

For personal and business customers making recurring euro payments, Barclays supports SEPA Direct Debits, allowing users to set up automated euro transactions with companies or individuals in Europe.

Multiple Fee Payment Options

Barclays offers three options for handling international payment fees:

- OUR: The sender pays all charges, ensuring the recipient gets the full amount.

- SHA: The sender covers Barclays’ fees, while the recipient pays any additional charges from intermediary banks.

- BEN: The recipient covers all charges, meaning they receive less than the sent amount.

Personal customers sending payments via the app must use the OUR option, while other channels provide flexibility. Business customers can select their preferred method when using Barclays Online Banking, telephone banking, or branch services.

Barclays Payment Limits

Personal customers can send up to £50,000 daily, while Premier and business account holders have a £100,000 limit. Individual transactions cannot exceed £50,000.

Foreign Currency Accounts for Businesses

Barclays offers foreign currency accounts in multiple currencies to reduce exchange rate risks and streamline international payments. Businesses trading in euros, US dollars, or Canadian dollars can benefit from same-day settlements, with most other currencies settling within two working days.

Multi-Channel Access

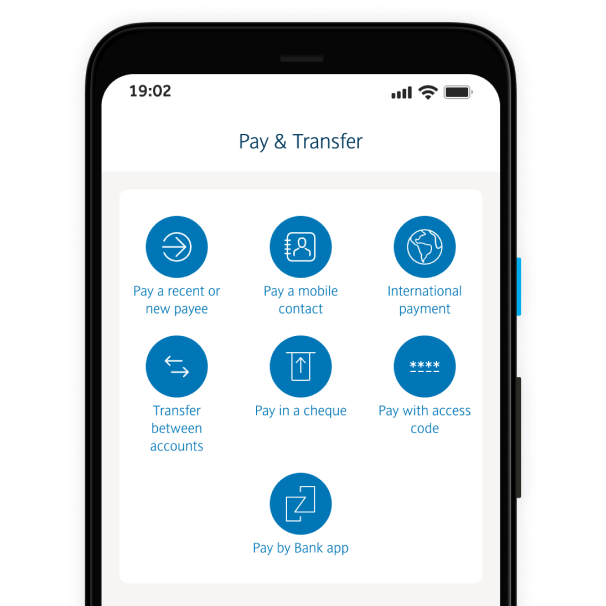

Both personal and business customers can initiate international transfers through:

- Barclays app (simplest option, but some limits apply)

- Online banking (wider limits, suited for larger transfers)

- Telephone banking (for Premier and business customers)

- Branch services (required for certain country transfers or large payments)

Barclays International Payments Pricing and Fees

Barclays’ international money transfer fees vary based on whether you’re a personal or business customer, the transfer method, and the payment type.

Personal Account Pricing

- Free for online and app transfers: Personal customers sending money internationally using the Barclays app or Online Banking don’t pay a transfer fee.

- £25 fee for assisted payments: If you make a payment in a branch or via telephone banking, a £25 fee applies—unless it’s a SEPA payment, which remains free.

- Fee-free transfers to Ukraine: Barclays has waived all transfer fees for personal customers sending money to Ukraine.

- Correspondent bank fees: Payments may go through intermediary banks, which could deduct charges from the final amount received.

Business Account Pricing

Business customers are subject to fees based on their account type and transfer method. Barclays offers Barclays International Payments Services (BIPS) and SEPA transfers, with pricing varying across different banking platforms (Online Banking, Barclays app, Barclays.Net, or in-branch).

- Online & app transfers: £15 for international transfers via BIPS, £0.35 for SEPA payments.

- Assisted payments (branch or telephone banking): £25 per BIPS transfer, £1.50 per SEPA transfer.

- Special tariffs for charities and some business plans: Certain account types, like Charity & Impact Accounts, enjoy fee-free SEPA transfers.

| Transfer Method | Barclays Business Account & Introductory Offer | Charity and Impact Account & Community Banking | Electronic Payments Plan | Mixed Payments Plan |

| Online Banking BIPS | £15 | £15 | £15 | £15 |

| Online Banking SEPA | 35p | £0 | £0 | 35p |

| Barclays App BIPS | £15 | £15 | £15 | £15 |

| Barclays App SEPA | 35p | £0 | £0 | 35p |

| Barclays.Net BIPS | £15 | £15 | £15 | £15 |

| Barclays.Net SEPA | 35p | £0 | £0 | 35p |

| Assisted BIPS (Branch/Phone) | £25 | £25 | £25 | £25 |

| Assisted SEPA (Branch/Phone) | £1.50 | £0 | £1.50 | 65p |

Barclays Global Payments Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Supports Payments to Over 200 Countries in 50+ Currencies | Business Customers Pay Higher Transfer Fees |

| Free Transfers for Personal Customers via the Barclays app and Online Banking | Business Customers Pya Higher Transfer Fees |

| SEPA Payments for Fast and Low-cost Euro Transfers | Daily Transfer Limits of £50,000 or £100,000 |

| Flexible, Multi-Channel Payment Methods Including In-Branch | Certain Country Transfers Require Branch Visits |

| Foreign Currency Accounts for Businesses | No Cash Pickup Service |

| Flexible Fee Payment Options |

Barclays Money Transfer Service Customer Reviews

As of February 2025, Barclays’ money transfer service has received mixed customer feedback, reflected in its 1.8 out of 5 Trustpilot rating from 11,750 reviews.

Many customers report smooth transactions, helpful staff, and proactive fraud protection. Barclays’ team is often praised for its professionalism in resolving payment issues and providing in-branch support. Extra security checks are widely seen as a positive, though some users experience occasional delays.

However, frustration is evident among others, particularly around strict security policies, transaction limits, and customer service difficulties. Common complaints include delayed payment approvals, excessive fraud detection measures, and unclear transfer limits—even when sufficient funds are available. Some customers also report challenges cancelling pending transactions or adjusting security settings, while telephone banking is frequently described as unhelpful.

In contrast, Barclays’ mobile app receives significantly higher ratings, with 4.8 out of 5 on the Apple App Store and 4.6 out of 5 on Google Play. Users praise its strong security, intuitive design, and convenient features, particularly for managing finances on the go. However, feedback isn’t all positive—technical issues, disruptive updates, and inconsistent functionality are common concerns. While many find the app reliable and easy to use, others struggle with customer support responsiveness and limited international payment options.

Barclays Money Transfer Security Measures

Barclays is regulated by the Financial Conduct Authority and employs advanced security protocols to secure money transfers. Key measures include:

- 24/7 Fraud Monitoring – Barclays continuously scans accounts for suspicious activity and alerts customers via SMS or automated calls when unusual transactions are detected.

- Multi-Factor Authentication (MFA) – Customers verify their identity through multiple layers of security, including the Barclays app, SMS verification codes, and PINsentry card readers.

- End-to-End Data Encryption – All online transactions are encrypted to safeguard sensitive payment details, preventing unauthorised access.

- Automatic Log-Outs – After 10 minutes of inactivity, Barclays logs users out of online banking to minimise the risk of unauthorised access.

- Login Protection – After three incorrect login attempts, accounts are automatically locked to prevent brute-force hacking attempts.

- Barclays Online Banking & App Guarantee – Customers are protected against unauthorised transactions and eligible for refunds if fraud occurs—provided they have not shared sensitive details like passwords or PINs.

- Suspicious Transaction Blocking—If Barclays detects unusual spending patterns, payments may be temporarily blocked until the customer verifies them.

- Secure Global Transfers – International payments processed through intermediary banks adhere to strict anti-money laundering (AML) and regulatory compliance standards for added security.

With these safeguards, Barclays ensures its customers can confidently and safely transfer money.

Barclays Recent Updates and Recognitions

Barclays is one of the UK’s largest and most established financial institutions, with a history dating back to 1690. Today, it operates in over 40 countries and employs over 80,000 people worldwide.

The bank is split into two key divisions: Barclays UK, which covers retail, wealth, and corporate banking, and Barclays International, which handles investment banking, global markets, and payments.

Over the years, it has pioneered several financial innovations, including deploying the world’s first cash dispenser in 1967.

Recently, Barclays has temporarily removed fees for sending money to Ukraine.

Conclusion

Barclays’ international money transfer service provides extensive global coverage, strong security measures, and multiple payment options, making it a solid choice for personal and business customers. Personal customers benefit from fee-free online transfers and fast SEPA payments, while businesses gain access to foreign currency accounts and flexible fee structures.

However, high fees for assisted transfers, strict security checks, and daily transfer limits may frustrate some users, particularly business customers who face higher charges. While the Barclays app is widely praised for its reliability and ease of use, in-branch and telephone banking experiences can be inconsistent.

Disclaimer

This article’s content is for general informational purposes only and should not be considered financial advice. While we strive to provide accurate and up-to-date information, financial services and regulations may change, and individual circumstances vary.

Before choosing a money transfer service or making any financial decisions, it is advisable to seek professional advice from a qualified financial expert who can assess your specific needs. Barclays and other services mentioned in this article may not be suitable for everyone, and factors such as fees, exchange rates, and regulatory requirements should be carefully reviewed.

We do not accept responsibility for any decisions made based on this information. Before proceeding, you should always check the latest terms, conditions, and policies directly with the service provider.

FAQs

Barclays’ fees for international money transfers vary based on the transfer method and destination. If you send money online, fees typically range from £0 to £25, depending on your account type. In-branch and telephone transfers usually incur higher costs. Additionally, exchange rate margins and potential correspondent bank charges may apply.

Depending on your method, Barclays may charge a fee to send money abroad. For personal customers, transfers made through online banking or the Barclays app are generally fee-free, while assisted transfers (via branch or telephone banking) incur a £25 fee. Business customers also face fees, with charges varying based on the transfer type and platform used, such as £15 for BIPS transfers via online banking or the app.

The time it takes to send money abroad through Barclays depends on the transfer method and destination. For most international transfers, Barclays offers standard options that take 3 to 8 working days. If you’re using SEPA for euro transfers within Europe, payments are often processed on the same day. Business customers can also choose priority transfers, which take 1 to 3 working days.

With Barclays, personal customers can send up to £50,000 per day for international transfers. Premier and business account holders’ daily limit increases to £100,000. However, individual transactions cannot exceed £50,000. These limits apply to most international payments made via online banking or the Barclays app, with higher limits potentially available through telephone banking or in-branch transfers.

You can use their online banking or mobile app to transfer money internationally from your Barclays account. You can also visit a branch or use telephone banking for assistance, particularly if you need to send larger amounts or require a different transfer method.