Consulting Our Global Network to Get You the Best Deals…

We Found 3 Providers That Match Your Needs

Mid Market Rate – 6.52

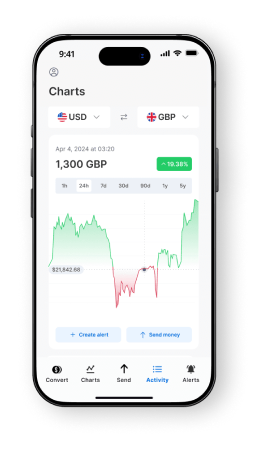

Create an Alert Sponsored

Zero transfer fees and/or preferential exchange rate on your first transfer

Sponsored

Zero transfer fees and/or preferential exchange rate on your first transfer

- Transfers to over 220 countries in 100+ currencies.

- Cash pickup options at 500,000+ locations.

- Card payments are processed almost instantly, and most bank transfers are same-day.

- Transparent pricing, with fees and exchange rates displayed upfront.

- Intuitive Xe app for managing transfers on the go.

- Real-time transfer tracking and alerts.

- Supports international payroll and supplier payments for business customers.

- FX risk management tools such as forward contracts, market orders, and option contracts.

- Integration with ERP systems like Dynamics 365 and Sage Intacct.

- No minimum transfer amount.

- Handles high-value transactions (up to £350,000 per transfer online).

- Some transfers may incur additional fees, especially for card payments.

- Bank and wire transfers can take up to 4 business days.

- Account setup and verification might take time based on documentation.

- No cash-to-cash transfers as it requires a bank, card, or digital wallet for funding transfers.

- Advanced tools like option contracts may be unnecessary for simpler needs.

- Integration into ERP systems may involve additional setup costs and effort.

- Entirely digital, which may not suit businesses preferring personal consultation.

- Supports 30+ currencies for personal customers and 70+ currencies for Business customers.

- Offers comeptitive interbank rates offered during market hours.

- Personal customers can make peer transfers typically delivered in 20 seconds.

- Business tools like limit orders and FX forwards to lock rates up to 2 years.

- Advanced security measures including two-factor authentication, biometric login, and real-time fraud detection.

- Business customers get monthly allowances for fee-free exchanges, scaling with plans, whilst Personal customers can access discounted fees based on their plan

- Free bank transfers inside the SEPA region for Personal customers

- 0.6% fee applies to exchanges above Business plan limits.

- Weekend mark-up of 1% on currency exchanges outside market hours for most plans.

- Limited support for certain currencies and countries due to sanctions.

- Fee discounts and free transfer allowances depend on paid plans, with free-tier users having the lowest allowances and highest rates.

Revolut is a financial technology company offering flexible currency exchange, money transfer, and payment solutions, catering to both personal and business users.

Revolut Personal is used by over 50 million users and allows transfers in 70+ currencies to 160+ countries through various payment methods, including instant peer-to-peer payments.

Revolut Business is ideal for international companies who want to exchange money in 30+ currencies at interbank rates. Key features include tools like forward contracts and automatic orders, as well as fee-free monthly allowances for currency exchanges based on different subscription plans.

Both account types prioritise security, transparency, and user-friendly features, making Revolut a versatile choice for personal and professional financial needs.

- Sending money to 40 currencies and 200 countries.

- Transparent fees and no hidden charges

- Uses real mid-market rates, ensuring fairness and avoiding markups.

- Offers same-day or even instant transfers on many routes, with updates and tracking available.

- Multiple payment methods (e.g., debit/credit cards, bank transfers, mobile wallets)

- Send up to £1 million per transaction depending on payment method.

- Guaranteed Rates locks in exchange rates for a set time to protect against currency fluctuations

- Features like 2-factor authentication and funds stored with established financial institutions for added safety.

- Manage transfers, check exchange rates, and repeat transactions easily from one platform.

- Seamlessly connects with accounting platforms like Xero, QuickBooks, and Shopify for easier financial management.

- Streamline recurring payments and manage expenses all from one account

- Receive email notifications when exchange rates are favourable

- Transfers involving less commonly used currencies or bank transfers can take up to 3 working days.

- Dynamic fees may apply for certain currencies or during volatile market conditions.

- Wise does not accept cash or cheque payments, limiting accessibility for some users.

- Rates are only guaranteed for a limited time, requiring prompt payments

- Certain specialised transaction types, like For Further Credit (FFC) payments, are not supported.

Wise, formerly TransferWise, makes international money transfers simple and affordable for individuals and businesses. Operating in over 160 countries with support for 40+ currencies, it offers competitive exchange rates and low, transparent fees. Most transfers arrive within one day, and some even instantly, through a secure and user-friendly platform. Regulated by the FCA in the UK, Wise ensures safe and reliable transactions.

- Transfers to over 220 countries in 100+ currencies.

- Cash pickup options at 500,000+ locations.

- Card payments are processed almost instantly, and most bank transfers are same-day.

- Transparent pricing, with fees and exchange rates displayed upfront.

- Intuitive Xe app for managing transfers on the go.

- Real-time transfer tracking and alerts.

- Supports international payroll and supplier payments for business customers.

- FX risk management tools such as forward contracts, market orders, and option contracts.

- Integration with ERP systems like Dynamics 365 and Sage Intacct.

- No minimum transfer amount.

- Handles high-value transactions (up to £350,000 per transfer online).

- Some transfers may incur additional fees, especially for card payments.

- Bank and wire transfers can take up to 4 business days.

- Account setup and verification might take time based on documentation.

- No cash-to-cash transfers as it requires a bank, card, or digital wallet for funding transfers.

- Advanced tools like option contracts may be unnecessary for simpler needs.

- Integration into ERP systems may involve additional setup costs and effort.

- Entirely digital, which may not suit businesses preferring personal consultation.

Set Up an Alert

We’ll keep you informed of changes in exchange rates, to make sure you get the best deal.

By signing up, you accept Currency Expert’s Privacy Policy and allow us to send you email alerts, occasional money transfer tips, advice and marketing emails. You can unsubscribe at any time. Privacy Policy

Currency Expert’s Recommendations

for Sending Money from Japan to Chile

The most affordable money transfer service available today might not retain its low-cost status tomorrow. To select the service that aligns best with your requirements and preferences, assess the top-performing options on our real-time rates engine for the past 30 days for transfers from the Japan to Chile.

Mid-Market Exchange Rate from

Japan to

Chile

Live JPY to CLP Mid-Market Exchange Rate – Updated in Real-Time

Send JPY to CLP – Best Money Exchange Rates Today

Learn More about Sending Money from Japan to Chile

We found 3 providers offering money transfer from Japan to Chile. The cheapest provider we found is Revolut. With this provider, you’ll be able to transfer money as fast as in a few minutes.

- Providers Found – 3

- Cheapest Provider – Revolut

- Fastest Transfer Time – Wise (0 to 3 Days)

- Pay-in Options – Bank Deposit, Card Transfer, Bank Transfer, Debit Card, Credit Card, SWIFT Transfer, Mobile Wallets, Balance, Direct Debit, ACH, Wire Transfer

- Pay-out Options – Bank Deposit, Card Transfer, Peer Transfers, Wallet Transfers, Bank Transfer, Mobile Wallet, Cash Pickup

- We Recommend – XE

Find the Best Deal to Send Your Money

Our Assessment Method

Our mission is to help you find the best money transfer provider for your needs. To achieve this, we employ a rigorous and ongoing evaluation method.

We constantly monitor the top money transfer providers, ensuring that our recommendations reflect the latest offers, pricing, and service updates. Our approach goes beyond surface-level overviews. We conduct an in-depth analysis of all the factors that matter to you, including:

- Exchange Rates: Reviewing live rates to help you maximise your transfers.

- Fees: Breaking down hidden costs and transparent pricing.

- Speed: Evaluating how quickly transfers are completed.

- Ease of Use: Reviewing apps, websites, and customer service.

- Security: Ensuring your money is safe and the provider is reputable.

- Coverage: Checking which countries and currencies are supported.

This allows us to present the most relevant and tailored results, no matter your unique situation. By choosing us, you can feel confident that you’re making informed decisions with the best data available.

Understanding the

Mid-Market Rate

The mid-market rate, also known as the interbank rate, is the midpoint between the buying and selling prices of two currencies in the global market. It’s considered the most accurate and fair rate for currency exchange.

However, when transferring money, banks and exchange services usually don’t offer the mid-market rate to customers. Instead, they add a markup for profit, meaning the rate you get for a money transfer is often less favourable.

For accurate and up-to-date information, we use XE’s mid-market rate API.

You’re in Safe Hands

At Currency Expert, we recognise that navigating the world of currency exchange and international money transfers can be daunting. With an abundance of providers, varying rates, and often complex fee structures, finding the right service for your needs is a critical but challenging task. This is where we come in.

Our mission at Currency Expert is to simplify this process, providing you with clear, unbiased assessments of money transfer providers. Our approach is rooted in a commitment to trust and transparency, ensuring that you have all the necessary information to make informed financial decisions.

Experience

Currency Expert is backed by a team of professionals who bring decades of experience in the finance and currency exchange sectors.

Insights

We believe in giving you a complete picture of the market. By evaluating a wide range of money transfer providers, we ensure that you have access to a diverse selection of options.

Results

Your financial advantage is our priority. We are constantly analysing the market to keep our information up-to-date, helping you to make decisions that are both financially sound and efficient.

How it Works

Input a few details

Inform us of the specific currency and the amount you wish to exchange.

Review Providers

Assess our trusted money transfer providers and find the right one for your needs.

Send Your Money

Once you’ve made your choice, click on the button and access the provider transfer page.